Tuesday, May 02, 2006

Kevin Cho

3/18/1982

My Videos

Email me

Archives

- 01/01/2005 - 02/01/2005

- 02/01/2005 - 03/01/2005

- 03/01/2005 - 04/01/2005

- 04/01/2005 - 05/01/2005

- 05/01/2005 - 06/01/2005

- 10/01/2005 - 11/01/2005

- 11/01/2005 - 12/01/2005

- 12/01/2005 - 01/01/2006

- 01/01/2006 - 02/01/2006

- 02/01/2006 - 03/01/2006

- 03/01/2006 - 04/01/2006

- 04/01/2006 - 05/01/2006

- 05/01/2006 - 06/01/2006

- 06/01/2006 - 07/01/2006

- 07/01/2006 - 08/01/2006

- 08/01/2006 - 09/01/2006

- 09/01/2006 - 10/01/2006

- 11/01/2006 - 12/01/2006

- 12/01/2006 - 01/01/2007

- 01/01/2007 - 02/01/2007

- 02/01/2007 - 03/01/2007

- 04/01/2007 - 05/01/2007

- 05/01/2007 - 06/01/2007

- 06/01/2007 - 07/01/2007

- 07/01/2007 - 08/01/2007

- 08/01/2007 - 09/01/2007

- 09/01/2007 - 10/01/2007

- 10/01/2007 - 11/01/2007

- 11/01/2007 - 12/01/2007

- 12/01/2007 - 01/01/2008

5 Comments:

http://www.consumeraffairs.com/news04/2006/04/oil_chevron.html

"The Bush years have been a record-breaking bonanza for the oil industry. The twenty-nine major oil and gas firms in the United States earned $43 billion in profits in 2003 and $68 billion in 2004. Oil profits were so high in 2005 that the top three companies alone (ExxonMobil, Chevron and ConocoPhillips) earned nearly $64 billion between them, more than half of which went to Texas-based ExxonMobil, which recorded the single most profitable year of any corporation in world history in both 2004 and 2005."

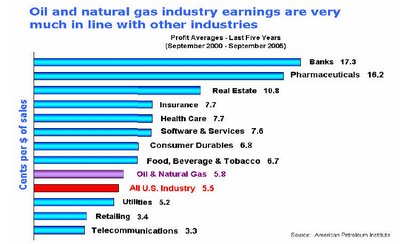

who's this. first, the absolute figure of earnings means nothing because oil industry is a HUGE industry. secondly, it's the profit margin that matters. financial industry makes way more money for each dollar invested. and trust me - if oil companies can't invest more and more money (and find more oil) because of some taxes imposed by the government, oil price will eventually go up even more. supply and demand is what it comes down to.

hey sorry that was me, i didnt know you could leave a name if u didnt login.

you cant just say it's a matter of supply & demand when there are so many more layers.

supply isn't necessarily down because oil is being rapidly depleted; production is down because of violence in nigeria, war in iraq, tensions with iran, etc. - geopolitical reasons.

katrina shut down refineries, and no new refineries have been built in the us since the 70s.

& it's not just some left-wing paranoia or a coincidence that bush and members of his administration are oil men, companies like exxonmobile took in a billion dollars a day last quarter, we went to war with iraq (third largest untapped petroleum), and now there are rising tensions with iran (2nd largest).

true, there's no evidence of collusion; but oil companies blame rising gas prices on lack of supply when execs know it's more than that; and why would they care when they're making record profits?

you are right. my point about the supply & demand was that, that's what it'll come down to if the government starts imposing new tax on oil companies and take away their resources to keep re-investing more money into explorations and such. it really will be about supply & demand then.

and again, you are right. there are many layers to the rising cost of gas. my point is precisely that. it's not the oil companies just gouging price to jack the consumers. and of course they're the beneficiaries of the rising cost of gas.

you make some good, logical points. and i like it =) all i was asking for is for ppl to not go all apeshit and blame oil companies without good reasons.

And until there is evidence of collusion, the data shows everything else that stands as the truth. that's all.

Post a Comment

<< Home